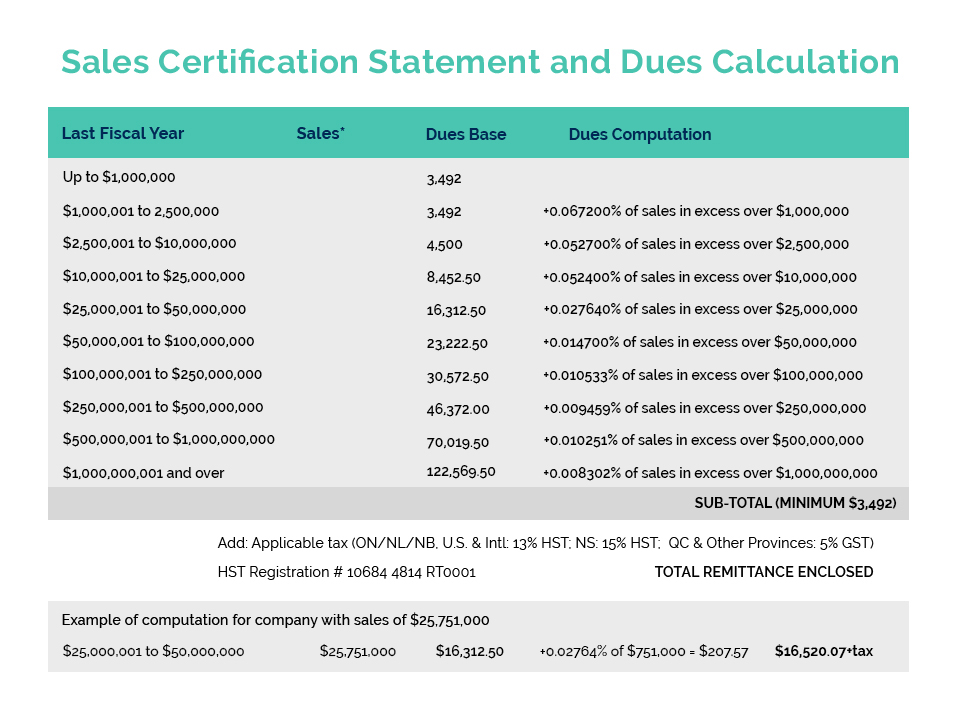

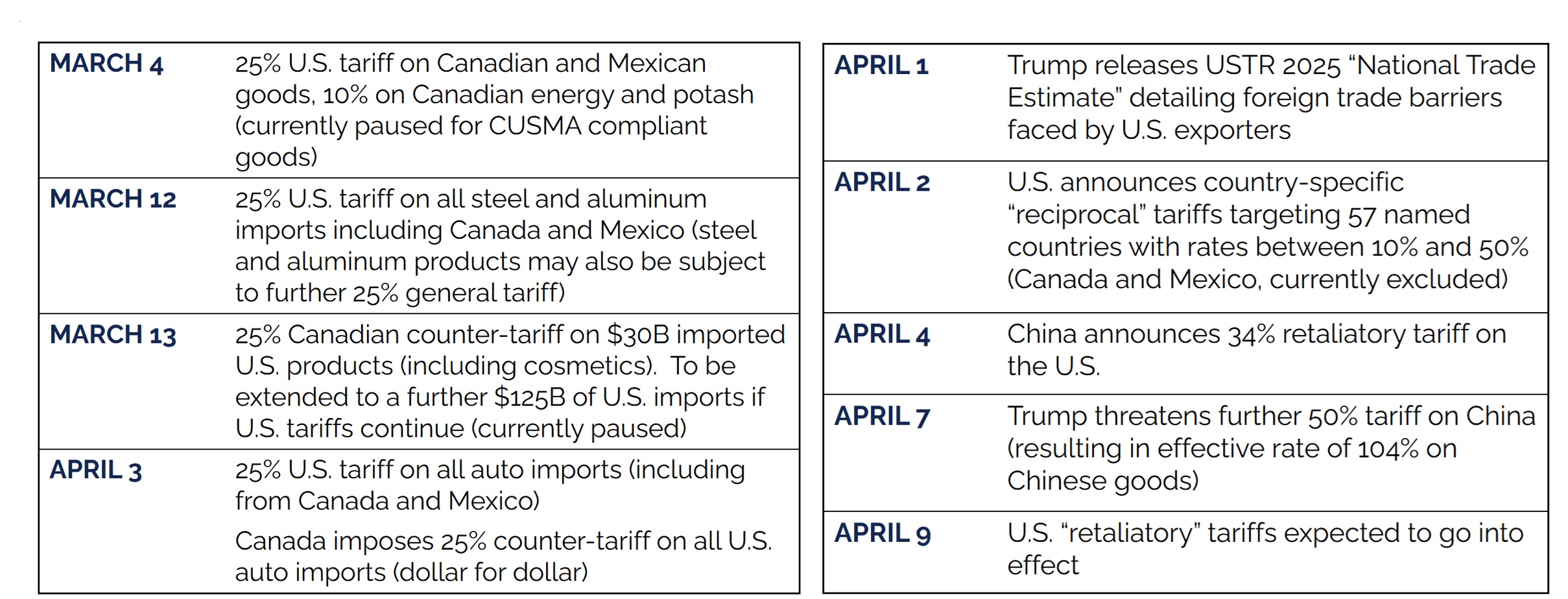

Even though Canada and Mexico were excluded from Trump’s recent round of so called “reciprocal” tariffs, Canada and Mexico remain locked in a trade war with the U.S. as Trump’s tariffs on steel, aluminum, and autos remain in place. Tariffs on steel and aluminum came into effect on March 12th which triggered Canadian retaliatory tariffs on some $30B CDN of U.S. imports including cosmetics. Following Trump’s further imposition of a 25% U.S. tariff on all autos imported into the U.S. effective April 3rd, Canadian Prime Minister Mark Carney imposed a 25% counter-tariff on all autos imported from the U.S.

TARIFFS & THE TRADE WAR – CANADA

Review of Current Tariffs & Counter-Tariffs (effective dates)

Canadian counter-tariffs of 25% on a further $125B of U.S. products have been prepared should they be required and may, in fact, have assisted in the U.S. excluding Canada from the “reciprocal” tariffs.

As to the auto tariffs, the U.S. is excluding the value of U.S. made parts in calculating the tariffs on autos manufactured in Canada or Mexico that are CUSMA compliant. Conversely, the Canadian counter-tariffs exclude the value of Canadian AND Mexican made parts in U.S. manufactured autos.

It is difficult to imagine the effort and record-keeping that will be required by auto makers to establish and prove the value of these components which can cross the border many times in such a highly integrated manufacturing process that is the North American auto industry.

The only certainly is that Trump’s tariffs will interrupt North American auto manufacturing and raise prices for consumers in all three countries. Tariffs specifically on auto parts have been threatened by Trump but not yet imposed. In addition to Canada and Mexico, auto manufacturing in other countries including the European Union are also affected.

It is anticipated that as an act of mutual goodwill in engaging in the renegotiation of the Canada-U.S.-Mexico agreement that these tariffs and counter-tariffs be lifted, it is also possible that Trump may decide to keep them in place for negotiation pressure. Time will, of course, tell what course may be taken. For our industry, there is no certainty at this time as to whether there will be any relief to the counter-tariffs on cosmetics, or if the U.S. tariffs on cosmetics will be introduced.